Many important, innovative and effective programs to address these issues have been implemented around the country and have had a positive impact on large numbers of people in the U.S. However, in total, these existing programs, while excellent in so many ways, have not been able to address the changing needs of unbanked people or […]

Research & Updates

Service Delivery – Financial Hubs

A Hub would consist of a location bringing together all the needed services to assist low and very low income, unbanked and underbanked households with bad credit (usually about 400 to 600 credit scores). The use of Hubs or financial centers could provide the most complete set of financial and […]

Reader’s Note: This post is the first in a series CDF is writing for the California Council of Churches on various financial services issues. The original version of this post can be viewed on their website: calchurches.org/financial-coaching.html. You may view or download a PDF version of […]

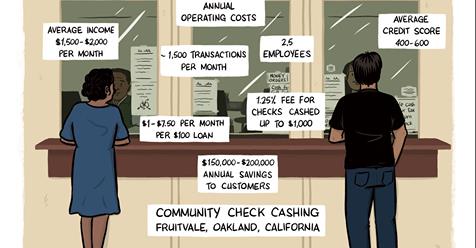

Writer and illustrator Susie Cagle has created a wonderful profile for Community Check Cashing’s non-profit business model, storefront, and lending program. Check out the full article in the The Nation online!

Can a New Kind of Payday Lender Help the Poor? Oakland’s Community Check Cashing offers […]

Comments on the CFPB’s Proposed Payday Lending Regulations

BUREAU OF CONSUMER FINANCIAL PROTECTION

12 CFR Part 1041

[Docket No. CFPB-2016-0025]

RIN 3170–AA40

Payday, Vehicle Title, and Certain High-Cost Installment Loans

Submitted By Community Development Finance 3411 East 12th Street, #124 Oakland, CA 94601 510 479-1037

October 6, 2016

Community Development Finance (CDF) operates […]

David Dayen, celebrated finance journalist, features Community Check Cashing in a CDFI/CCC-focused article in Salon!

One little storefront in Oakland cannot change the world. Or maybe it can. With enough funding, a non-profit foothold in the small-dollar loan market can ease the burden of perpetual debt on vulnerable communities. And Community Check Cashing’s […]

(by Matt Stannard, Occupy.com. Originally published at TruthOut, April 23, 2016)

Dan Leibsohn has been concerned about economic injustice and insecurity for a very long time. “I have tried to address issues of social justice in all of my work throughout my adult life,” says Leibsohn, founder of Community Development Finance, an […]

Interested in how Payday loans compare to the other financial issues faced by underbanked populations? You’re in luck! In the following draft PDF, CDF founder Dan Leibsohn shares draft research conclusions from data generated through CDF’s flagship Community Check Cashing nonprofit money services storefront.

Click to view or download via PDF: Payday Loans, Debt […]