Service Delivery – Financial Hubs

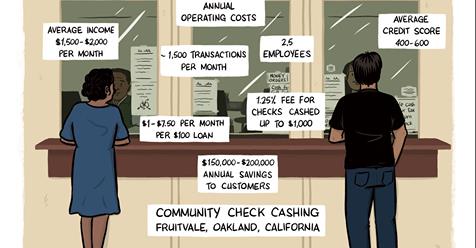

A Hub would consist of a location bringing together all the needed services to assist low and very low income, unbanked and underbanked households with bad credit (usually about 400 to 600 credit scores). The use of Hubs or financial centers could provide the most complete set of financial and […]